A Quick and Easy Solution for Your Australian Online Tax Return Demands

A Quick and Easy Solution for Your Australian Online Tax Return Demands

Blog Article

Optimize Your Advantages With the Online Tax Obligation Return Refine in Australia

Browsing the on the internet tax return procedure in Australia provides a strategic benefit for people looking for to maximize their economic benefits. By comprehending the nuances of the on the internet declaring framework and the key deductions readily available, one can substantially improve their tax obligation placement.

Comprehending the Online Tax System

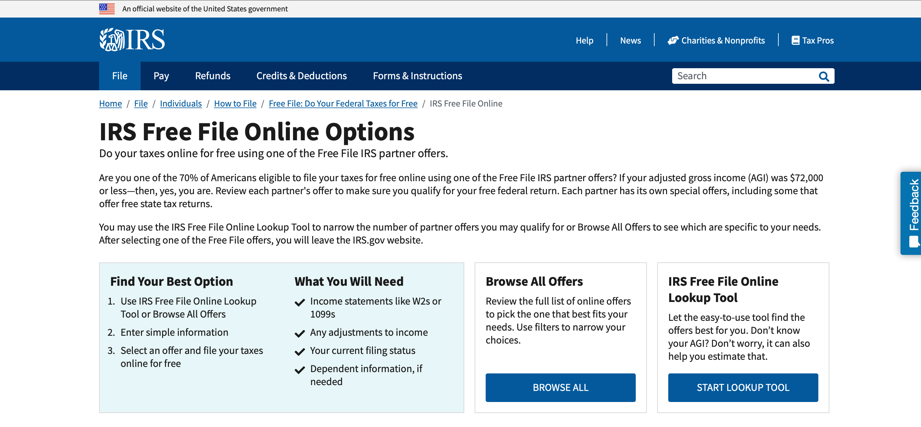

Comprehending the on the internet tax system in Australia is necessary for taxpayers looking for to navigate their responsibilities effectively. The Australian Taxes Workplace (ATO) has structured the process, allowing people to submit their income tax return online, thus boosting accessibility and minimizing the moment needed for submission. Australian Online Tax Return. This system is designed to fit a vast array of taxpayers, from staff members to freelance people, with different choices that cater to their specific scenarios

To start, taxpayers need to sign up for an account on the ATO's online system, which works as a central hub for managing tax-related activities. As soon as signed up, customers can access their tax obligation details, consisting of revenue statements and deductions, directly from their employers and financial establishments. This feature simplifies the process, as it reduces the demand for hand-operated data entrance.

Additionally, the online system offers real-time updates and alerts, making sure that taxpayers continue to be educated about their tax obligation standing. The ATO's on-line resources additionally include tools and guides to assist customers in understanding their obligations, making the process much more transparent. In general, leveraging the online tax obligation system not only improves effectiveness yet also encourages Australians to take control of their tax obligation obligations properly.

Trick Deductions and Discounts

Among the numerous aspects of the Australian tax obligation system, vital reductions and rebates play a vital role in lowering the overall tax burden for individuals. Deductions are specific expenses that taxpayers can declare to decrease their gross income, effectively reducing the amount of tax obligation payable. Common reductions include work-related expenses, such as uniforms, devices, and travel expenses, which are incurred while earning a revenue.

Furthermore, taxpayers can assert reductions for self-education expenditures that directly connect to their current work or enhance their skills.

Recognizing these crucial deductions and refunds is essential for optimizing possible tax cost savings. People need to keep detailed documents of their costs and seek advice from the Australian Taxation Workplace (ATO) standards to ensure all qualified insurance claims are precisely reported, making certain a much more beneficial tax result.

Step-by-Step Filing Guide

When approached carefully,Filing your tax return in Australia can be a streamlined process. Australian Online Tax Return. Begin by collecting all necessary documents, including your PAYG recaps, bank declarations, and invoices for insurance deductible expenses. Ensure you have your Tax Obligation Documents Number (TFN) helpful, as it is essential for identification

Next, pick an appropriate online platform for declaring. The Australian Tax Workplace (ATO) uses an on-line solution that overviews you through the process. Produce or log into your MyGov account connected to the ATO.

Once logged in, follow the prompts to complete your tax return. Input your income details precisely and guarantee you declare all qualified reductions. This could include job-related expenses, charitable contributions, or financial investment expenses.

After completing all relevant details, assess your return diligently to make sure accuracy. It's a good idea to examine that all figures are properly gone into and that you have not missed any type of reductions.

Usual Blunders to Avoid

When completing your tax obligation return online, it's important to recognize common challenges that can result in inaccuracies or hold-ups. One regular mistake is overlooking to collect all required paperwork before beginning the procedure. Guarantee that you have your income statements, invoices for deductions, and any other appropriate financial details easily available.

One more common error is stopping working to verify the precision of personal details. Simple errors, such as wrong names or tax obligation documents numbers, can result in processing delays or complications. Australian Online Tax Return. Be careful additionally to properly report all income sources, consisting of sideline or financial investments, as omitting earnings can result in charges

Additionally, lots of taxpayers ignore declaring qualified deductions. Acquaint on your own with readily available deductions to optimize your benefits. On the other hand, beware not to case reductions that do not put on you, as this can activate audits.

Resources for More Assistance

Numerous resources are offered to assist taxpayers navigating the online income tax return procedure in Australia. The Australian Taxation Office (ATO) gives thorough on the internet support, including comprehensive guidelines and FAQs tailored to the online income tax return system. Their web site includes a committed area for individuals, helping taxpayers recognize their responsibilities, privileges, and reductions.

Along with the ATO sources, various tax software application systems use straightforward user interfaces and detailed support. A lot of these platforms include inbuilt calculators and devices to maximize reductions, making certain taxpayers can maximize their returns successfully.

For personalized support, taxpayers can access specialist tax obligation advisory services. Qualified tax obligation specialists can provide tailored guidance and aid, which is especially helpful for those with complicated economic circumstances or unfamiliarity with tax legislations.

Area companies likewise use workshops and workshops, concentrating on tax education and support, particularly for low-income income earners and pupils. Websites such as Community Tax Aid Australia give important understandings and assistance to help taxpayers comprehend their legal rights and responsibilities.

Conclusion

In conclusion, utilizing the on the internet tax return procedure in top article Australia presents a useful chance for taxpayers to enhance their financial end results. Ultimately, a comprehensive understanding and calculated approach to on-line tax obligation declaring can lead to substantial tax cost savings and enhanced compliance with responsibilities.

On the whole, leveraging the on the internet tax obligation system not just improves effectiveness yet also encourages Australians to take control of their tax commitments properly.

Amongst the different elements of the Australian tax obligation system, essential deductions and rebates play an important role in reducing the total tax obligation weblink problem for people.Countless resources are readily available to help taxpayers browsing the online tax return procedure in Australia. The Australian Tax Office (ATO) offers extensive on-line guidance, including comprehensive directions and FAQs customized to the on-line tax return system. Eventually, a complete understanding and calculated strategy to on-line tax declaring can lead to significant tax obligation savings and boosted conformity with commitments.

Report this page